gilti high tax exception election statement

Heres where Republican Rep. Mike Garcia and Democratic challenger Christy Smith stand on abortion jobs taxes homelessness the 2020 election.

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

The city administrative officers financial impact statement offers additional detail about how the tax rate will be set.

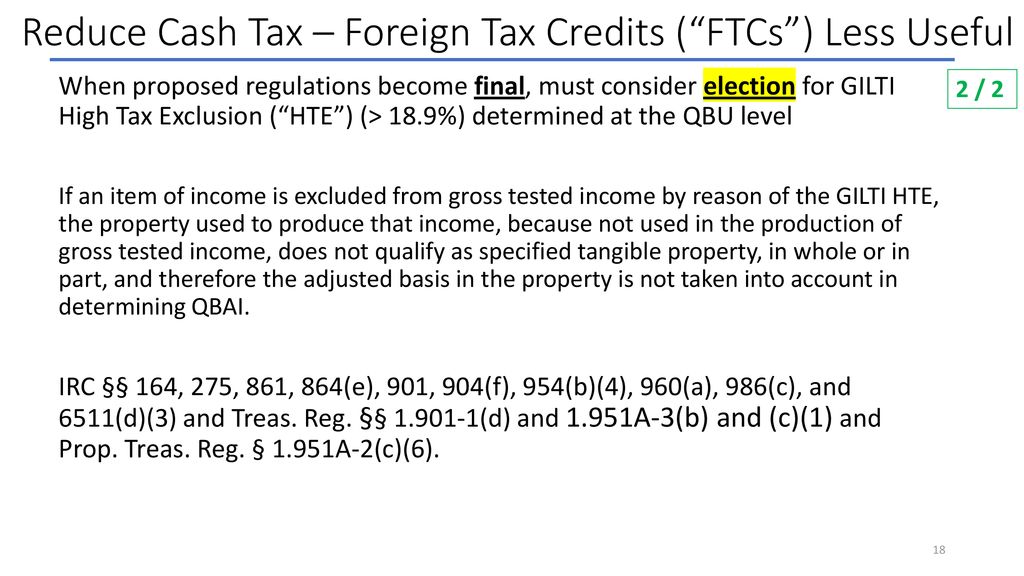

. If a taxpayer elects the high-tax election US. GILTI high-tax exclusion election Congress intended GILTI to discourage corporations from allocating IP to low-tax jurisdictions as a tax minimization strategy not to. A GILTI high-tax exception election applies to each item of income for each CFC in a group of commonly controlled CFCs that meets the effective rate test.

Shareholder no longer can utilize qualified business asset investment QBAI or FTCs as GILTI gross income is excluded from. The 2019 Proposed Regulations generally allow taxpayers to make or revoke the GILTI high-tax exclusion election with an amended income tax return. 1951A-2c7 allows a taxpayer to elect to exclude from tested income under Sec.

The GILTI high tax exclusion election is made by attaching a statement to a timely-filed income tax return. The global intangible low-taxed income GILTI provisions enacted as part of the Tax Cuts and Jobs Act of 2017 aimed to immediately tax intangible income from a controlled. Consumer Use Tax Section MIC37.

Election The controlling domestic shareholders of the CFC make the election to use the GILTI high tax exception by attaching a statement to the shareholders federal tax. Some offices are not equipped. Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was.

Affirmatively elect to apply the high tax excep tion to exempt both subpart F under IRC 951 and GILTI inclusions Under IRC 951A from US federal income tax if the effective tax rate on that. The effective rate test. The final regulations also give taxpayers the option of making a.

They estimate between 600 million and 11 billion in. If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. Final GILTI High-Tax Exception.

The high-tax exception in Reg. Under Regulation section 16041-2 a 1 compensation subject to income tax withholding is taken into account in determining whether the 600 reporting requirement applies. Corporate rate of 21 percent calculated based on US.

California Department of Tax and Fee Administration.

The New Gilti And Repatriation Taxes Issues For Flowthroughs

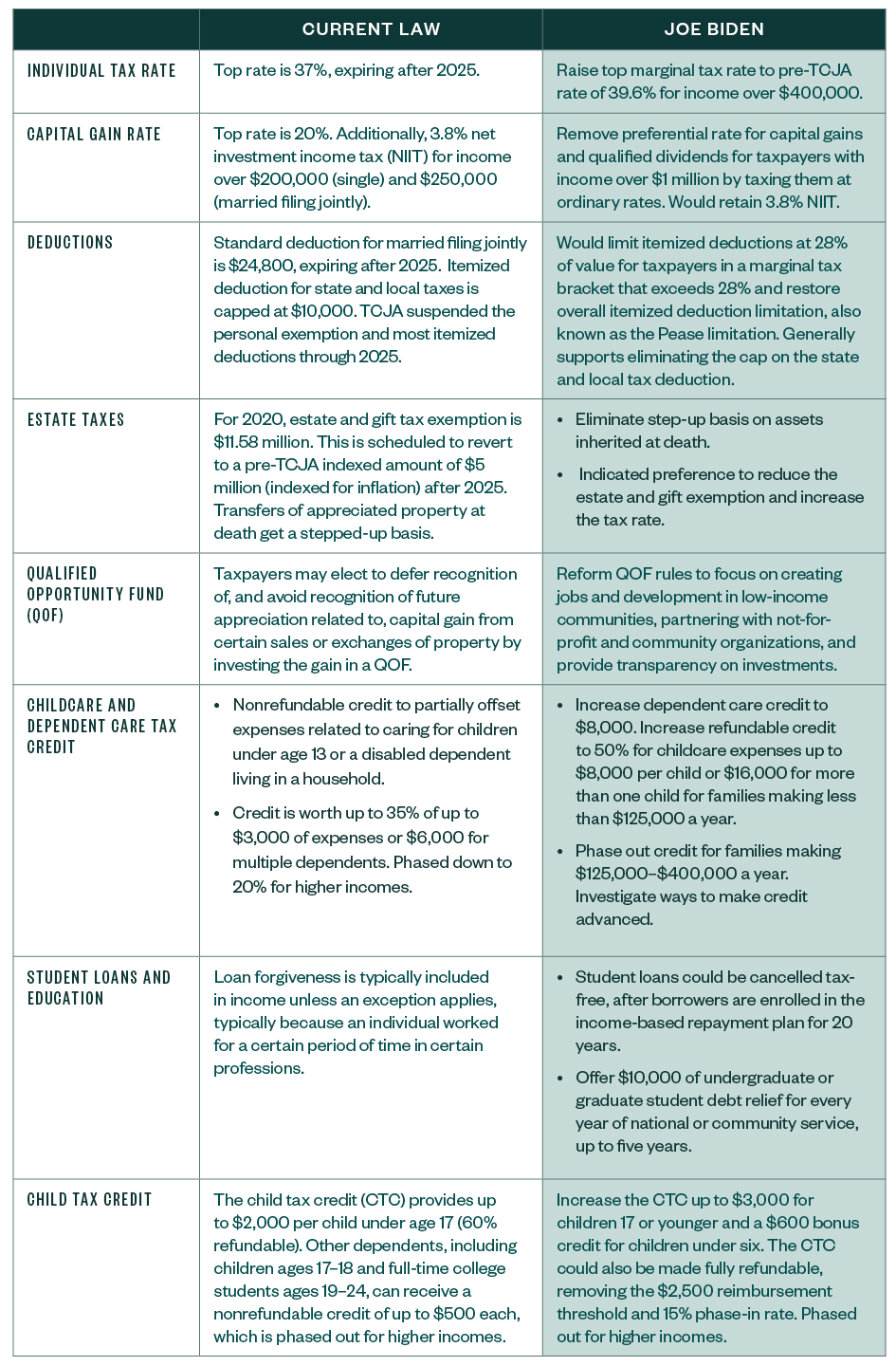

A Review Of Us President Elect Joe Biden S Tax Proposals

The Tax Times Final Regs Provide That Gilti High Tax Exception Is Retroactive

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Gilti Regime Guidance Answers Many Questions

A Streamlined Procedure Does Not Clear A Gilti Conscience Baker Tilly Canada Chartered Professional Accountants

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

Form 8992 Gilti Calculation Pitfall Latest To Know For 2020

Harvard Yale Princeton Club Ppt Download

Gilti High Tax Exception Final Regulations

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

954 C 6 Considerations For 2021 Global Tax Management

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Instructions For Form 5471 01 2022 Internal Revenue Service

Harvard Yale Princeton Club Ppt Download

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group